- No rush to get easy monetary policy

- Another 0.5% cut is expected; whether it occurs in one cut or two 0.25% cuts remains to be seen.

- The Federal Reserve forecasts interest rates to land at 3.4% in 2025, implying a full percentage point of cuts next year, followed by another 0.5% in 2026.

- The Fed will stay flexible, with data driving the pace of future rate changes.

- Investors should not expect 0.5% cuts to become the norm—the Fed will act based on new data.

- “I don’t see anything in the economy right now that suggests that the likelihood of a recession, sorry, of a downturn, is elevated,” - Jerome Powell

Stormrake Spotlight: FANTOM ($0.64)

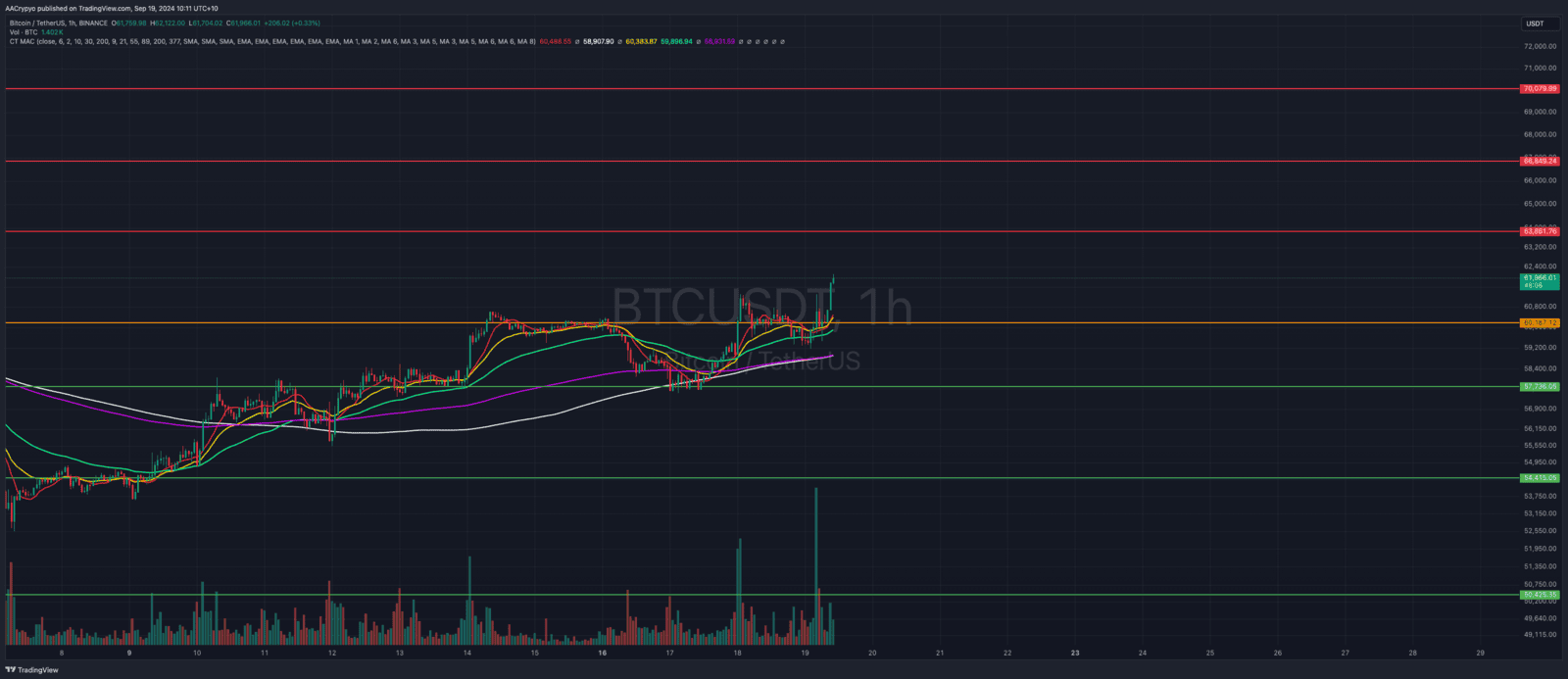

BTC/USD Key Levels and Price Action:

(ETF flow data is sourced from https://farside.co.uk/btc/ and reflects figures at the time of writing.)

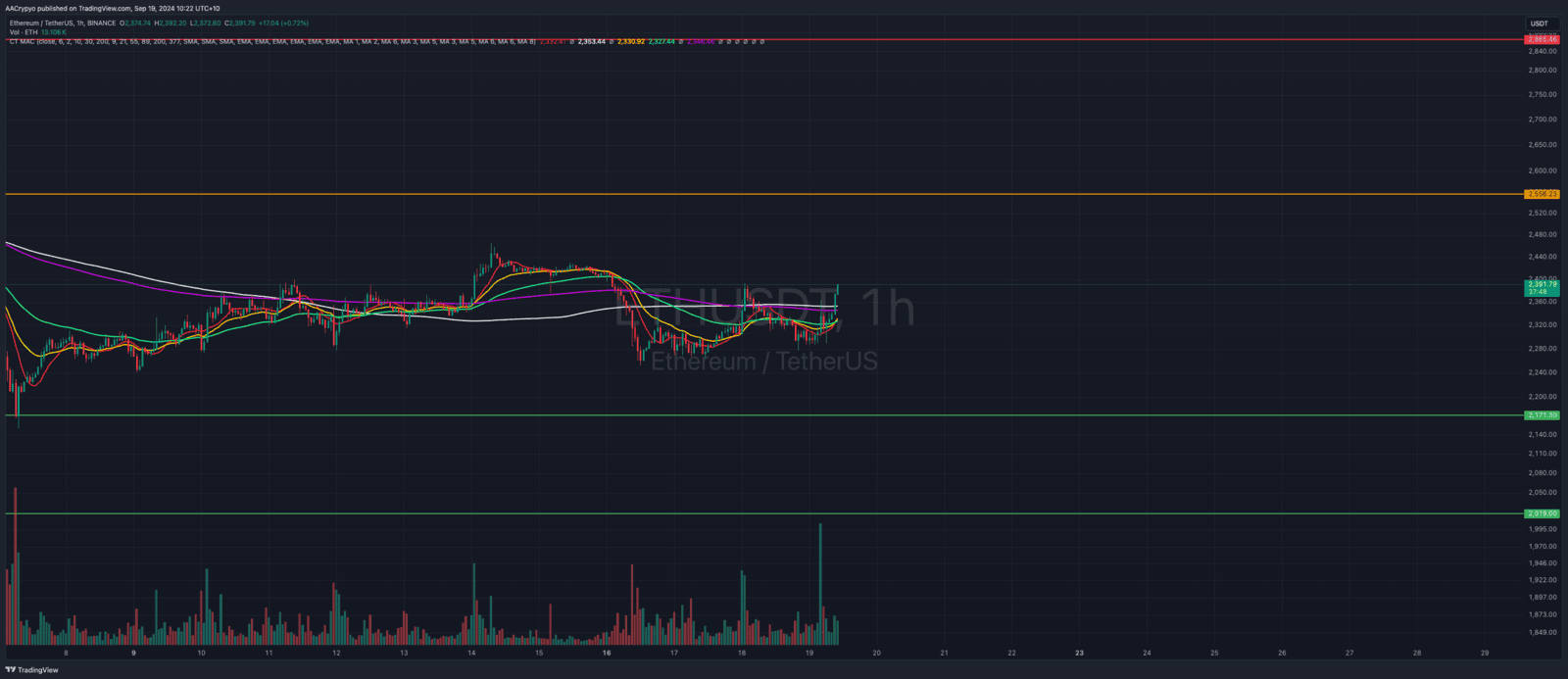

ETH/USD Key Levels and Price Action:

Written by Alexandar Artis

Create a brokerage account today

Reach out to us at Stormrake for further market insight and allow us to help you navigate the sea of mania and laser-eye memes, so that you can realise your goals in the market!

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2024 Stormrake Pty Ltd, All rights reserved