The Rake Review: June 2022

Welcome to the Stormrake monthly Australian crypto market & education update.

For sophisticated investors who want to expand their crypto knowledge.

Summary:

If you are a busy investor that doesn't have time to read this whole newsletter here is a brief summary:

* Goldman Sachs circles around Celsius assets - contagion worries as LUNA fallout continues

* Large Interest rate rises in the US and Australia

* Bitcoin drops below $20,000 USD and ETH below $1000 USD

* Inflation blame game continues as cost of living spirals

* 30 June deadline approaching for Aussie investors

or read below for all the details.

Well it wouldn't be the first time Bitcoin was declared dead, in fact you can track its obituaries here.

The recent sell off is a combination of:

- Sell pressure by traders who are shifting from "risk on" to "risk off" investments with the prospect of rising interest rates.

- Market contagion from a number of investment firms experiencing margin calls and distress.

- 3AC (A large victim of last month's Terra/Luna collapse)

- Celsius (Suspending withdrawals and hiring an agency in preparation for potential bankruptcy)

- Voyager (survived via a bailout from Alameda)

- Lower investor sentiment due to declining prices. Sentiment reached a low of 6/100 during the dip below $20,000 USD, which is the lowest rating we've ever seen. Sentiment measures greed and fear using internet search data.

See below for a visualisation on how this drawdown compares to previous dips.

While we all enjoy a bull market, it's important to reflect that nothing has changed in fundamentals. Bitcoin continues to produce blocks and no market operator has had to step in to ensure operation of the market.

Tick Tock, Bitcoin makes the next block.

https://bitinfocharts.com/comparison/bitcoin-confirmationtime.html

Last Days Before June 30

If you're looking to add to, or reduce your position before the end of the financial year then contact your broker, as you've only have a few more days.

Let's get into the news and events:

|

Video of the MonthSome tips on dealing with the bear market on "No Money But Dreams" Episode 1 with Bisher Khudeira |

Markets

Prices broke through resistance earlier this month and are generally down across the board. Global Market Cap is below $1Trillion USD. As a result 2 of the top 4 are stable coins (and 3 of the top 8). ETH is hovering just above $1,200 USD. Solana has been kicked out of the top 8 on structural concerns. It's tough out there with blockchain analysis suggesting the average investor is now in a loss position. Bitcoin rebounded over 20% since hitting a low of around $17,500 USD but is still well below last month's close.

* Top 8 coins by market cap thanks to CoinGecko

In the NEWS

Interest Rates

- Central banks everywhere are hiking rates to curb inflation. Here are the changes in central bank interest rates vs inflation rates.

Cost of Living

- Citing cost of living pressures, the fair work commission increased minimum wages by 5.2%. This aligns with the Q1 inflation figure of 5.1% however, the RBA expects inflation to hit 7%

- Cost of Lettuce hits $12 in QLD

- Fuel Prices on the rise with no reduction in sight

- The inflation adjusted cost of living is still getting worse

Inflation persistence

Even with the rate hikes, inflation is still persistent:

- Phillip Lowe is worried about sustained inflation and an “inflationary mindset”, a backflip from, “The situation in Australia is quite different”

- Phillip Lowe admits his mistake on no rate rises until 2024.

- Yellen also admits her “transitory” inflation projection was wrong

- Ray Dalio predicts a painful stagflation

Inflation Blame Game

We’re increasingly seeing the blame game with inflation:

- The Whitehouse blaming Russia's War in Ukraine

- Biden blaming Greedy corporations

- Vladimir Putin called out his Western counterparts and demonstrated a solid grasp on global economics.

Blame in times of inflation is not without precedent:

“It was natural that a people in the grip of raging inflation should look about for someone to blame. They picked upon other classes, other races, other political parties, other nations. In blaming the greed of tourists, or the peasants, or the wage demands of labour, or the selfishness of the industrialists and profiteers, or the sharpness of the Jews, or the speculators making fortunes in the money markets, they were in large measure still blaming not the disease but the symptoms.”

Adam Fergusson, in his 1975 book "When Money Dies" on the collapse of the Weimar Republic.

The financial pressure is already too much

This week we’ve unfortunately seen:

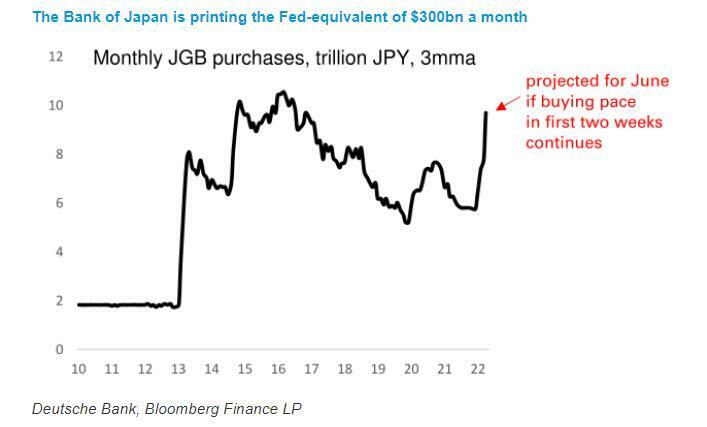

The humanitarian impact will be profound and sadly many more countries will follow. We're keeping our eye on the Bank of Japan as western developed countries seem to be following the Japanese path with regards to money printing and currency debasement.

A doctor looking at the Japanese bold yields might suspect the patient is having a cardiac arrest.

Japanese 1 to 30yr bond yields (Credit Preston Pysh)

Hard Money Fundamentals and Gresham's Law

Hard Money Definition:

Hard money is any form of money that is likely to hold its value over time through its inherent difficulty to increase in supply. - Stormrake 2022

Explanation:

Money has existed in many forms throughout human history. Anything can take the form of money as long as it can be traded. Throughout history we have seen that no matter what authority issues money or how strong the link between money and trade, the easier the money is to inflate - the faster it loses value over time. Examples are numerous but our favourite might be seashells. As crazy as it may seem today seashells were used as money all over the world from Africa & Europe to Australia. Shells were popular as they were easily transportable and commonly available. However, pretty soon it became obvious that you'd be better off going to the beach and looking for shells than working in your 9-5 (or whatever hours people kept back then). As soon as supply increases due to it being too easy to collect shells - the value of shells falls against all forms of better money (including scarce assets). Just like shells, other forms of soft money continuously fall against the value of hard money which is hard to inflate.

Gresham's Law definition

Gresham’s law, observation in economics that “bad money drives out good.” More exactly, if coins containing metal of different value have the same value as legal tender, the coins composed of the cheaper metal will be used for payment, while those made of more expensive metal will be hoarded or exported and thus tend to disappear from circulation.

- Britannica

Explanation:

People hold on to scarce hard money and spend easy money. People in central and southern America know this rule too well. For Venezuelans, it is imperative to spend their Bolivars asap (before the prices rise further) and to keep their US dollars. They know that dollars are more likely to hold value over time because its supply is not being inflated as badly as the Bolivar.

The Hardest Money of all:

Bitcoin has the following characteristics making it the hardest money ever.

Total Maximum Supply:

21 Million bitcoins - that's it. No other money can say that there is an exact finite supply. On top of that all lost bitcoins reduce the maximum supply so the real achievable supply is 10-20% lower.

Reducing Inflation:

Over 90% of the 21 Million has already been released meaning there is less than 10% to release over the next 100+ years. Every 4 years the supply per block halves and the money becomes even harder. The next halving event is less than 2 years away.

Decentralisation of Control:

The entire supply mechanism is secured by unbreakable encryption and decentralised, meaning no one has control. That's a huge feature because it means you don't need to trust anyone to not debase your money. No one has the power to issue more bitcoins than is already programmed.

Bitcoin Market Price on a Log Scale:

This month we revert back to the circular 4 year log chart. With bitcoin dipping under $20,000 USD it seems relevant to review. We can see the old rule that bitcoin has never been lower than 4 years prior still holds (the line has never crossed over itself). However, we were briefly lower than the 2017 high of 20,000 USD which is a price achieved 4.5 years ago. Will we ever see a crossover?

Monthly Memes: