The Rake Review: September 2023

The Rake Review: September 2023

Welcome to another monthly Rake Review as September finally ended and October (The best performing month - historically) can start. We've seen more big news and events and we will digest them for you below.

Stormrake Recognised

Awards mean nothing and this one is no different. Your favourite Crypto Broker has been recognised as:

Most Innovative Crypto Brokerage Firm 2023 – Australia

The only thing that matters to us is the performance of our customers portfolios and the quality of our service. We shrug this off and keep building a better product for our clients.

(Apologies for the shameless self promotion :)

Sam Bankman Fried - Trial Begins Tomorrow

SBF (now known as Scam Bankrupt Fraud) will be in court tomorrow for the start of his trial. The once high flying FTX boss will be facing a maximum sentence of over 100 years.

However, news is better for victims of FTX's as more money than expected has made it back into administrators coffers. Markets are pricing in well over a third of funds to be returned to creditors which is a lot more than previously thought given the movement of funds off the exchange in November 2022.

BlockFi the bankrupt crypto lender has also had progress with the managements plan being approved by a large majority. The hope is for some funds to be returned to creditors within 90 days.

Celsius is also fairing better than expected. A possible restart is on the cards which may be the best way forward to recover the most funds.

More good news for Gemini Earn creditors also. The current plan (as hopeful as it may be) is saying that creditors could recover up to 110% of their funds. If that dream happens it would really be something.

Why are we telling you all this? Well, overall these failures in late last year hurt the crypto ecosystem greatly. Now that there is hope of getting funds back, it is highly likely this will act as a bullish lead for crypto markets. FTX in particular is currently keeping a lid on Bitcoin. The court approved all Bitcoin holdings to be sold to recover USD so that FTX administrators can pay back creditors in USD. In turn, that USD could (in large part), flow back into Bitcoin once it is distributed. The only question is when.

Bitcoin Supply Shock Incoming

The supply of coins on exchange is historically very low. According to Coinglass, less than 10% of Bitcoin supply is accessible through exchanges. That means the rest is safely put away in cold storage or similar. Available supply is extremely low.

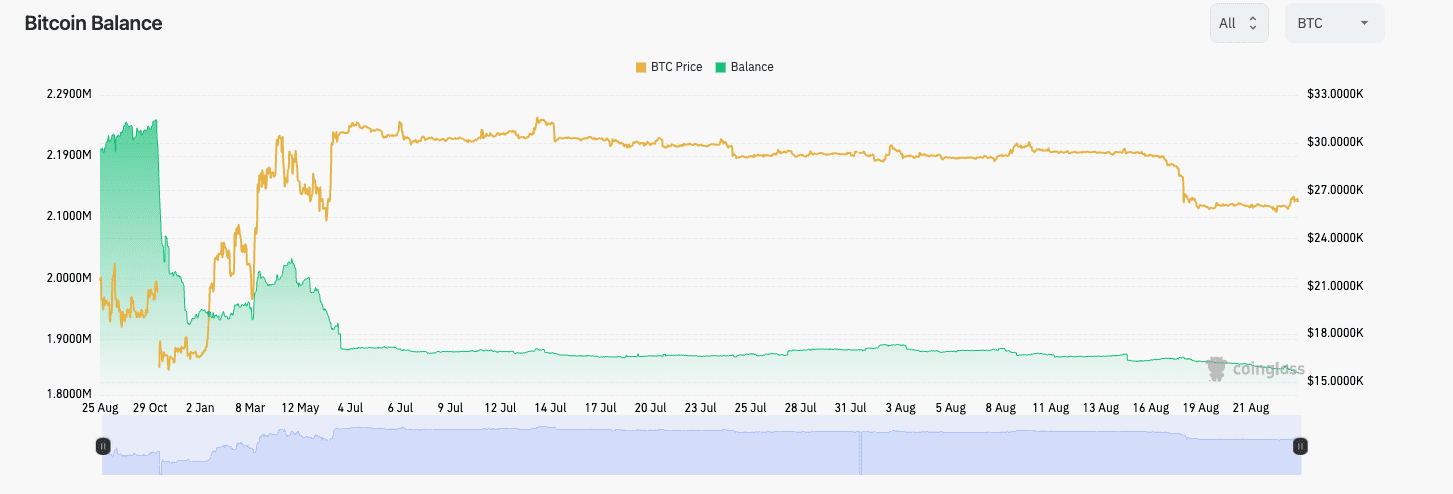

Look at the green line below. Less than 2 Million BTC is on exchange.

Bitcoin on exchange is now at a 5 year low, despite 5 years of mining adding to the supply. There is significant accumulation going on amongst the whales (large holders) and according to some reports Wall St funds are starting to accumulate a position ahead of launching their ETF's. It's an environment where any demand shock could spark a sharp rise.

USDT Volume Significant

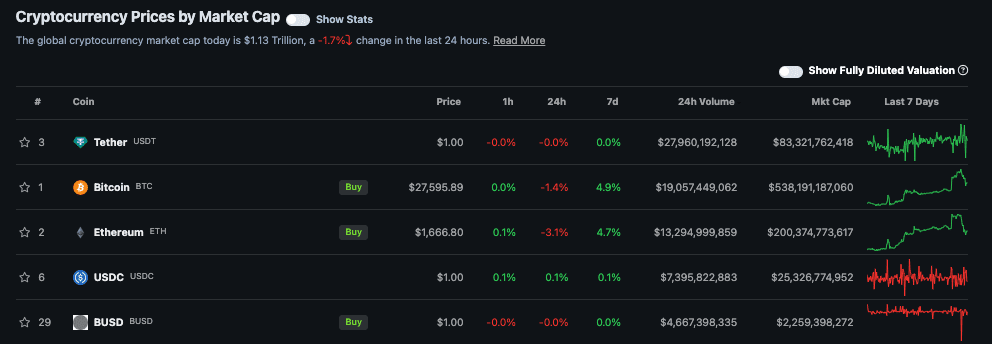

While Bitcoin is the leader by Market Capitalisation, it is USDT that boasts the largest turnover (volume). Above, you can see USDT having significantly higher volume than any other coin or token.

Stablecoins generally tend to have a higher turnover to market cap ratio. 3 of the top 5 coins above are stablecoins. USDT is the current king of the stablecoin market with USDC suffering reputational damage this year but still managing 7 Billion volume in a day.

The reason stablecoins are so often traded is that the price point they have makes sense to people (unit of account). It is also preferred as a settlement mechanism for large short term transactions because the relative price (by definition) won't move significantly.

It is a useful construct in the short term, but has significant risks, including centralisation risk and regulatory risk. Not to be confused with genuine investments stablecoins are more of a tool, or slightly more useful dollar. Also not to be confused with Central Bank Digital Currencies, which are the devil.

ETH ETF's

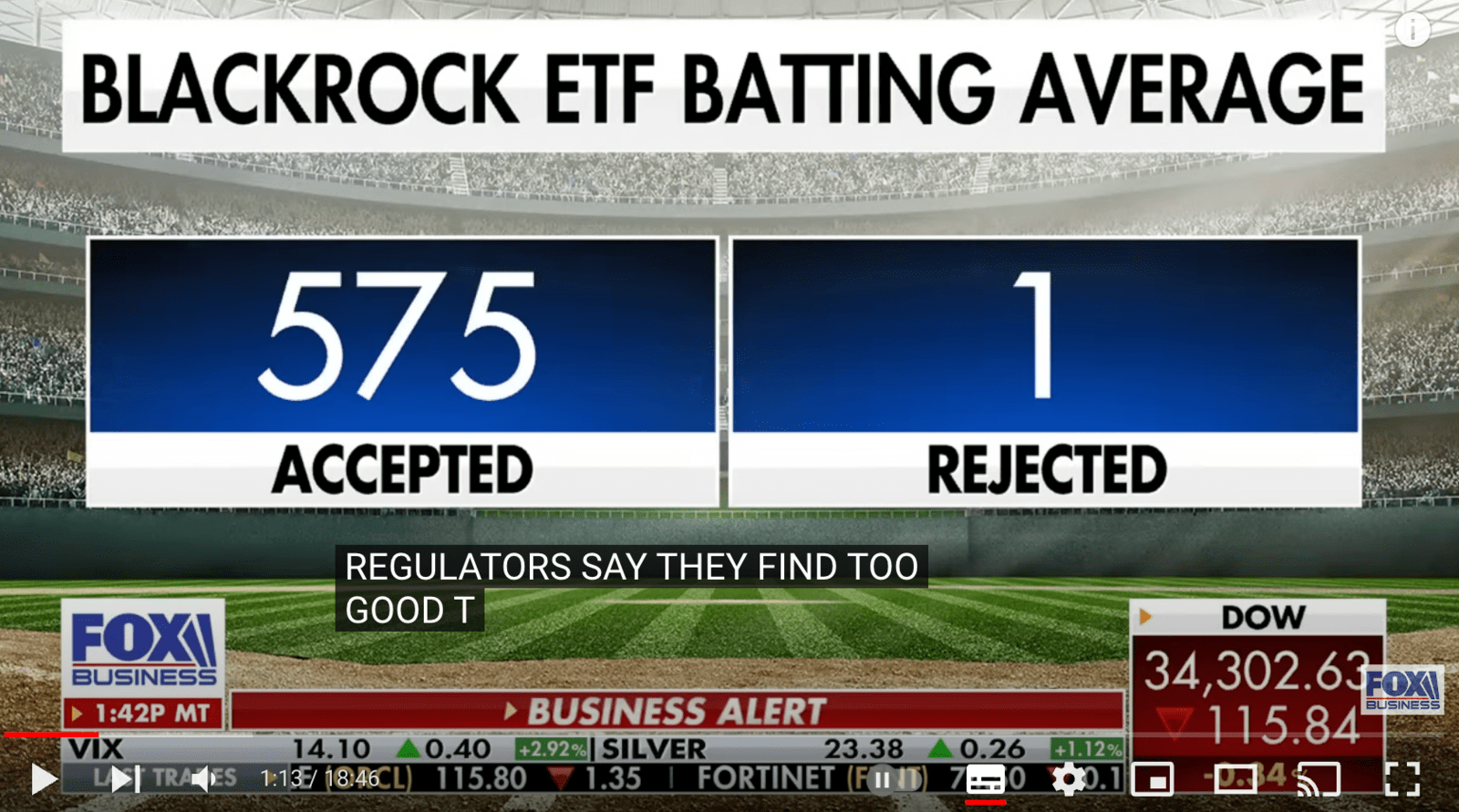

After filing Bitcoin ETF applications along with a swathe of others, Grayscale has applied for an ETH ETF also. Just as a reminder, an ETF allows investors to access crypto through a stock market mechanism. Effectively it allows for the purchase of Crypto without having to take the risk of holding it yourself.

The backlog of US ETF applications for BTC and ETH is getting ridiculous and it seems the SEC are determined to hold the gates for as long as possible while European ETF's have already taken off.

BTC Halving Coming Soon

The Bitcoin Halving is just over 6 months away. In April, the amount of BTC released every block will halve lowering supply to hit the market. In the past this has helped put a supply shock into the market and we have seen what can happen to price. Don't get caught short.

Market Update

Here is the fast five of what you need to know about the market in September 2023:

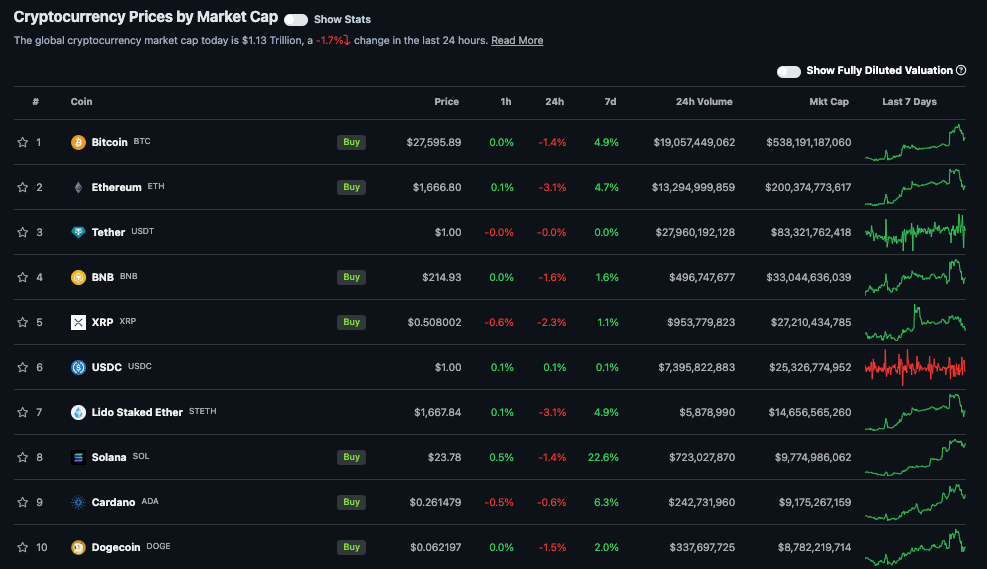

- Very little change in the top 10 reflects a largely sideways market as we tick towards the halving in April. The Bulls and Bears are evenly weighted. Who will break the deadlock?

- Volatility is slowly increasing off a historic low.

- Altcoins have underperformed, losing market share against Bitcoin.

- Solana (SOL) has recovered 20% in the last week and risen to 8th biggest.

- Arbitrum (ARB) is also recovering 13% in a week to $0.93

Video of the month

Bitcoin OG and entrepreneur Erik Vorhees, delivered a brilliant presentation at Permissionless II. We have it here for you in full. Take the time to watch as it is really powerful.

In the news

- You might've been called a conspiracy theorist if you thought Bitcoin was being held down on purpose by government. News this week confirms your suspicions though. Senator Bob Mendez, known for his anti-Bitcoin stance has been charged with bribery after allegedly accepting swathes of cash, gold and mortgage payments in return for voting against the interests of crypto.

- Microstrategy tops up again. The largest corporate holder of BTC has topped up again with another cheeky $147M USD BUY.

- Aussie Interest Rates on Hold again as the AUD falls against the USD (& USDT)

- The Greyscale discount to NAV has fallen to just 20% as the company becomes likelier to allow redemptions/ get bought / or convert to an ETF.

- Stormrake to speak at the ATAA 2023 National Conference at the Sheraton Grand Hotel in Sydney 22 October 2023. This will be live-streamed but if anyone is in Sydney and would like to attend please let us know.

Education

Education

Diversification. Don't just stake your life on one Memecoin.

Memes of the month

Start Your Brokerage Account

If you enjoyed this Rake Review, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2022 Stormrake Pty Ltd, All rights reserved