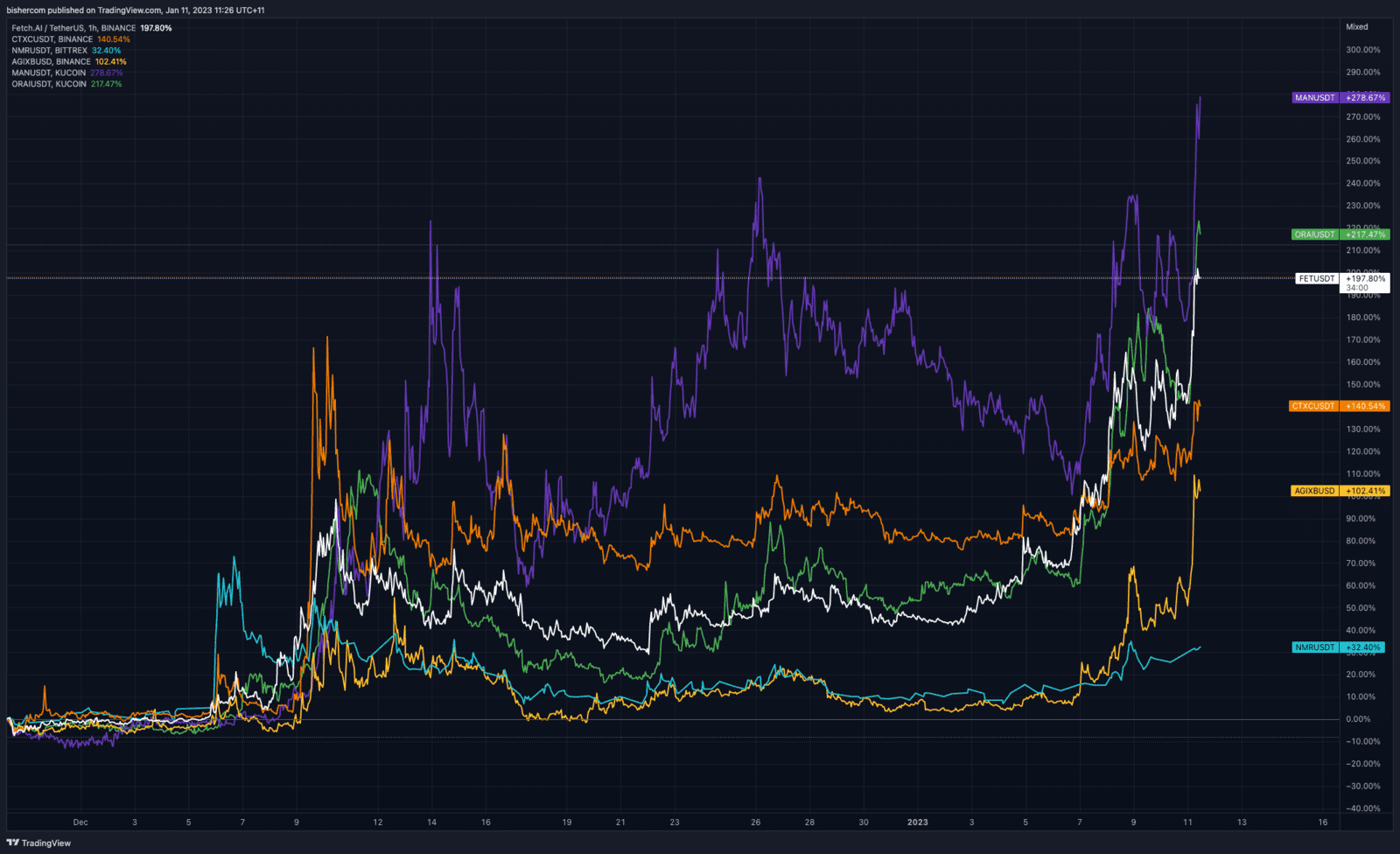

With the raging success of ChatGPT and stable diffusion, AI has been burst into the cultural zeitgeist in 2023. As always, when creativity and speculation collide, there will be a cross section of crypto tokens that manifest themselves as top performers within the crypto sphere.

The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

AI Basket Outperformance

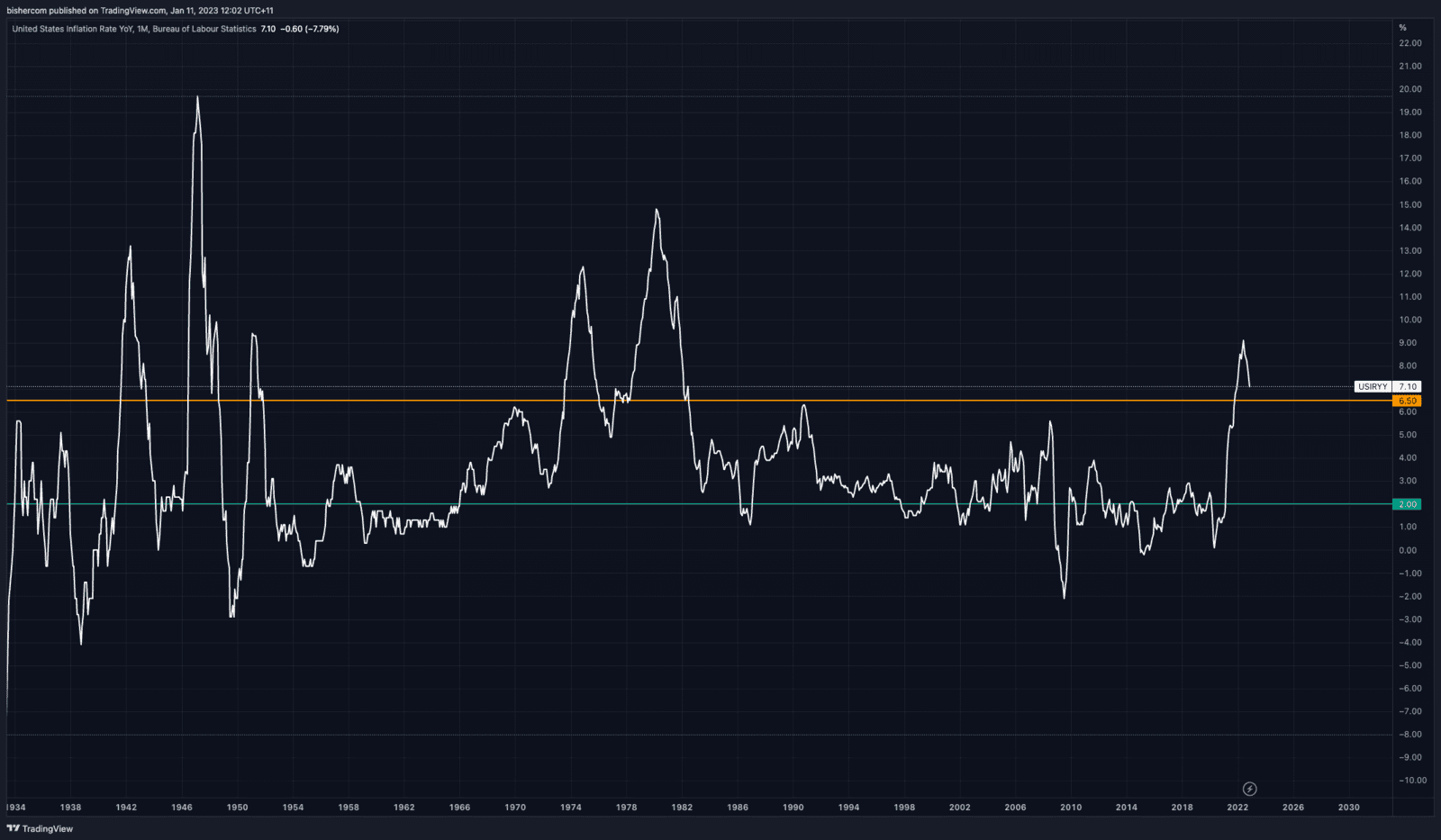

Cooling Inflation Can Supercharge Risk Assets

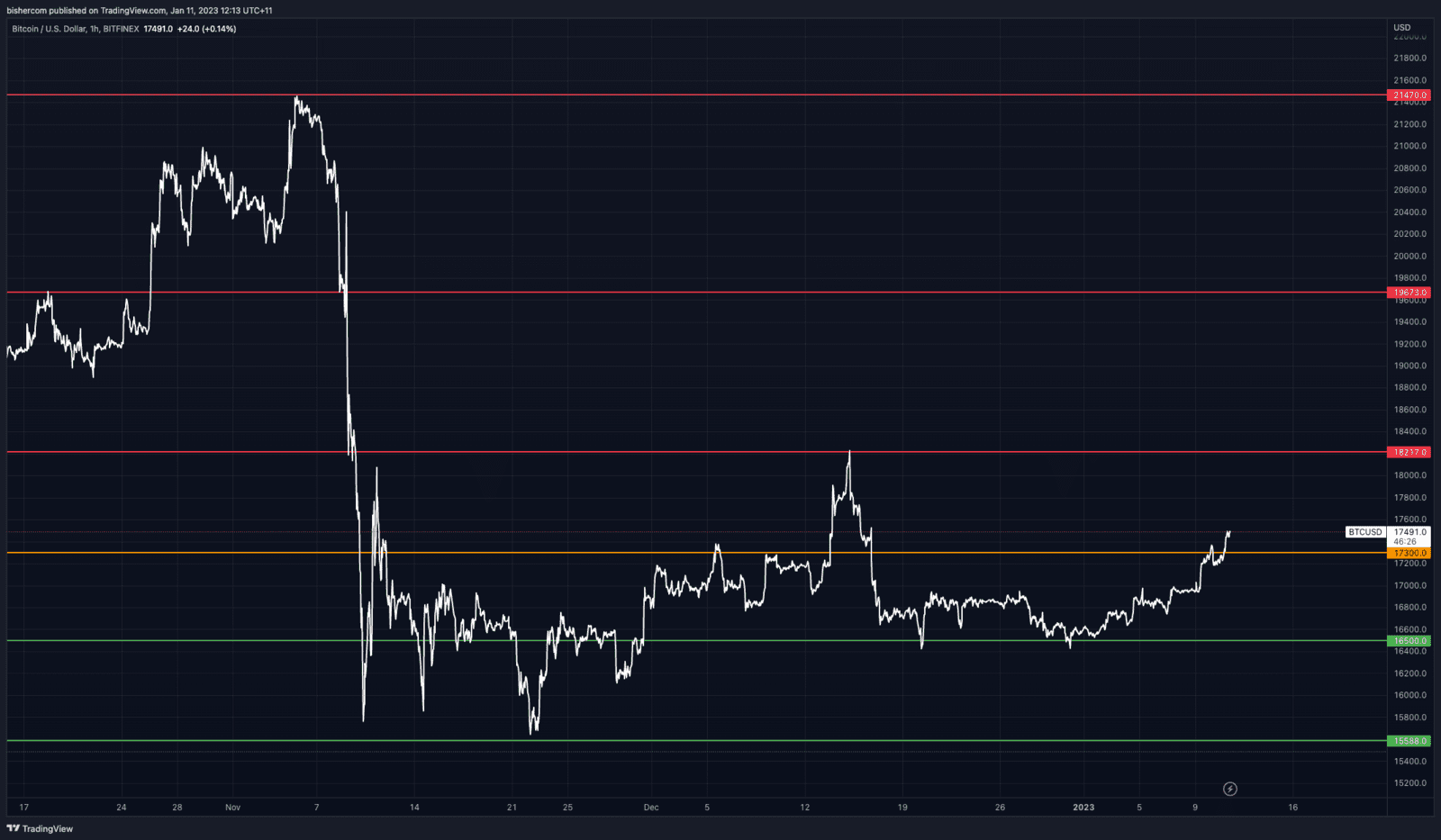

BTC/USD Key Levels

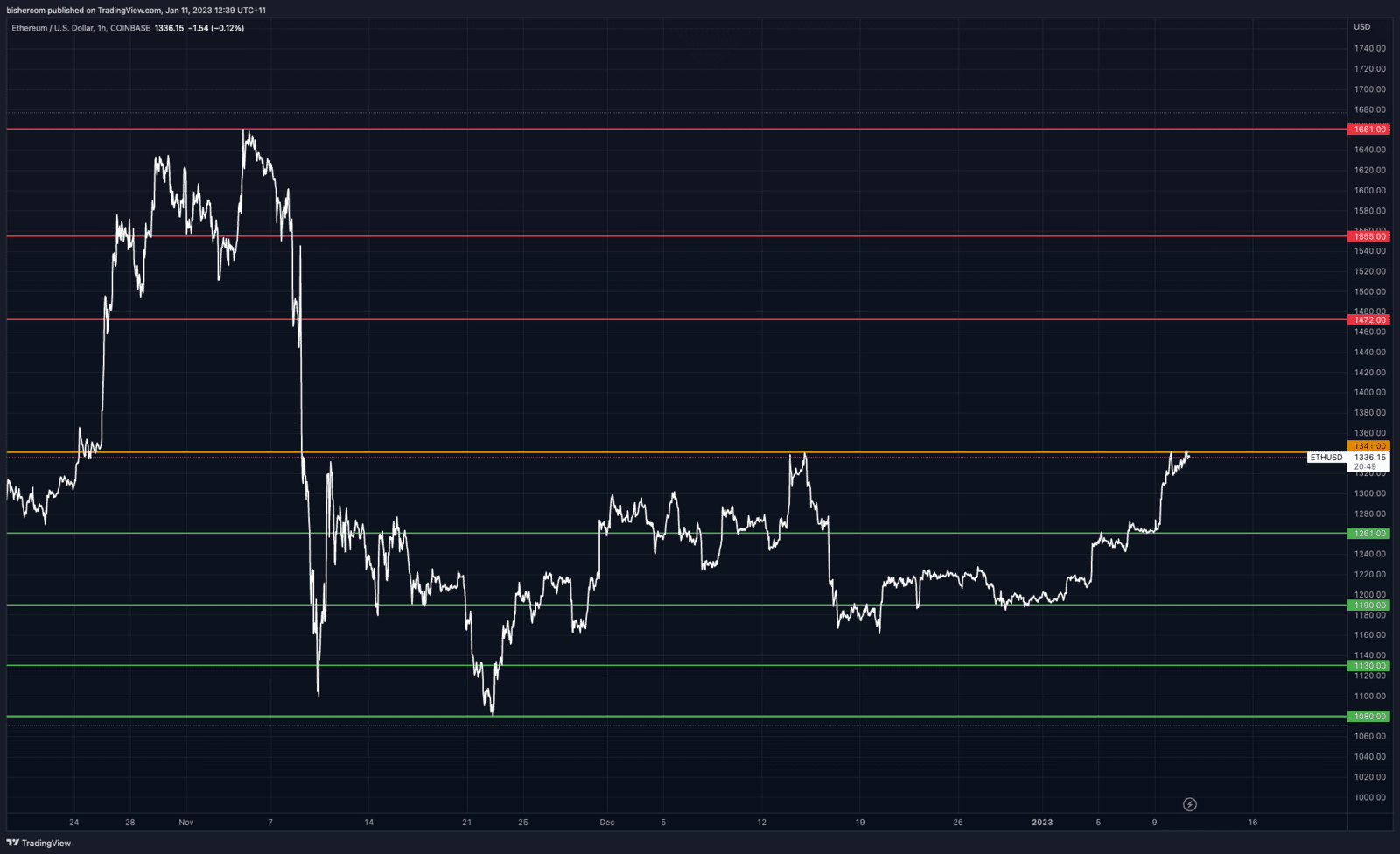

ETH/USD Key Levels

Ethereum has just retested our key level of $1,341 USD which was highlighted in our previous Morning Note. Should we close above $1,341 on the daily chart, we will look for a move towards $1,472, in the case that $1,472 gets broken, watch for a continuation towards $1,555 before major resistance comes into play. To the downside, if we fail to close above $1,341 and close below $1,261, watch for a retest of $1,190. Should $1,190 fail to hold, major support comes into play at $1,090.

Activate Your Brokerage Account

If you enjoyed this Morning Note, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2022 Stormrake Pty Ltd, All rights reserved