The Rake Review: March 2023

The Rake Review: March 2023

- The banking crisis continues but the haemorrhaging seems to be contained by a clever money printing scheme named BTFP (Bank Term Funding Program)

- The fate of ~4500 regional US banks under dire threat of money rushing to the safe “To Big To Fail” big 4 banks

- BRICs nations gain support as alternative to the SWIFT/US dollar system

- Crypto & Cash crackdown by Banks and Governments; potentially a lead to CBDC

- Operation “Crypto Choke Point” appears to be underway

- ANZ will no longer offer cash withdrawals at branches

- The US FED increases rates by 0.25%. RBA expected to hold

- Major cracks in real estate markets

A New Money Printing / Yield Curve Control

A joint announcement by the US Treasury, FDIC and Federal Reserve introduced a new BTFP program to prop up banks that had significant (unrealised) losses in the bond markets.

Many banks needed propping because they had made significant bets on long term bonds which had dropped significantly in value as interest rates have risen.

A quirk in the accounting requirements had allowed banks to report bonds as being worth more than they could be sold for on the open market, when in fact, many were under water.

We covered this in more detail at the start of the regional banking crisis in our Thunder Trading article here. In that article, we covered the dramatic shift in expected federal funds rates as many predict the FED may ‘pivot’ soon to begin reducing interest rates.

Not so fast!

Jerome Powell went ahead with a 0.25% increase in rates, in an attempt to continue reducing inflation as well as the FED balance sheet. We expect the FED will hold rates for as long as possible until we see strong signs of recession that makes cuts unavoidable.

We see the combination of rate hikes, and the BTFP program as effectively having the foot on the accelerator and brake at the same time.

Rate hikes reduce the money in the system (Quantitative tightening), while the BTFP program increases it. For a deeper explanation of why BTFP is effectively money printing, we highly recommend this Arthur Hayes article.

And just like that, the FEDs balance sheet quickly expanded.

Market Update

Wobbles in the traditional banking & finance sector have seen a resurgence in crypto markets across the month. It has been a strong month for all the majors but the last week has seen steady markets apart from XRP rising on the back of positive rumours around the SEC court case.

Video of the month

This month’s video is just 5 minutes and simply breathtaking.

Watch Janet Yellen's response as the BTFP program calls into question the fundamentals of free markets with the perverse incentives against regional banks.

Further Bank Contagion

Australia has a “Big Four” approach to banking but ~4500 US community banks are in dire risk of collapse and consolidation into the “Too Big To Fail” big 4 US banks (JPMorgan Chase, Bank of America, Wells Fargo, and Citibank).

This may seem not relevant to us back in Aus, but 4500 banks collapsing is a massive political risk in the US, and can therefore have broad impacts to the actions of the US Government and hence, global markets. The recent Credit Suisse collapse is a prime example.

Source: https://www.bankingstrategist.com/community-banks-number-by-state-and-asset-size

Balaji's $1m USD Bet

If you’re not familiar with Balaji Srinivasan, he is a well respected and very smart man. He did a great, 8 hour podcast with Lex Friedman that is highly recommended if you can find the time.

Balaji is declaring that the time for a transition from US dollars to Bitcoin is upon us and he is calling for people to get themselves into the Bitcoin lifeboat. He even went ahead to make an extraordinary 1 Million USD bet that this would occur within 90 days.

I will take that bet.

— Balaji (@balajis) March 17, 2023

You buy 1 BTC.

I will send $1M USD.

This is ~40:1 odds as 1 BTC is worth ~$26k.

The term is 90 days.

All we need is a mutually agreed custodian who will still be there to settle this in the event of digital dollar devaluation.

If someone knows how to do this… https://t.co/hhPr522PQupic.twitter.com/6Aav9KeJpe

We don’t believe Balaji entered the bet to win it. If he wanted to take that bet there are significantly cheaper ways to get that exposure in the market. Balaji did this to amplify his warning and try to save people. Balaji is a technology visionary with a very successful career. He was also very early to sound the alarm on covid.

Going viral

— Balaji (@balajis) January 30, 2020

What if this coronavirus is the pandemic that public health people have been warning about for years?

It would accelerate many pre-existing trends.

- border closures

- nationalism

- social isolation

- preppers

- remote work

- face masks

- distrust in governments

Balaji does a great job explaining his reasoning and backs it up with lots of resources and research. It is for this reason that we recommend every also watch him explain for himself:

Crypto Choke Point

There is a growing concern that recent government actions are deliberately restricting the crypto markets in an attempt to cut off people from exiting the Fiat system.

Nic Carter called this out 7 weeks ago here:

First they ignored Bitcoin, then openly laughed at it. Now comes the long awaited fight.

Recent events certainly paint a strong picture. Nic sums it up well with the following

The SEC announced a lawsuit against the crypto infrastructure company Paxos for issuing the BUSD stablecoin.

Crypto exchange Kraken settled with the SEC for offering a staking product.

SEC Chair Gensler openly labeled every crypto-asset other than Bitcoin a security.

The Senate Committee on Environment and Public Works held a hearing lambasting Bitcoin for its environmental footprint.

The Biden administration proposed a bill that singles out crypto miners for onerous tax treatment.

The NY Attorney General declared Ethereum, the second-largest crypto-asset, a security.

The SEC continued its anti-consumer protection efforts by doubling down on their attempts to block a spot Bitcoin ETF in court as well as trying to stop Binance US from buying the assets of the bankrupt Voyager.

The OCC let crypto bank Protego’s application for a national trust charter expire without approval.

The SEC sent Coinbase a Wells Notice, indicating its intent to bring enforcement actions against them for a variety of their business lines.

Read Nic's full article here or listen to Nic Carter on Operation Choke Point here.

To add to this:

SEC Charges Tron founder Justin Sun on security violations

EU clamping down on cash and crypto transactions.

Gary Gensler calls for funds to clamp down on crypto

BRICs expansion on US dollar concerns

The BRICs nations, (of Brazil, Russia, India, China, South Africa), have been working to form an international currency settlement system outside of the US backed SWIFT system. This is partly due to the increasing weaponization of the US dollar via various sanctions. Unconfirmed reports suggest it will commence August 1st, 2023.

According to South Africa Foreign Minister Naledi Pandor, at least 12 nations have applied to join BRICS movement, including:

Saudi Arabia

UAE

Egypt

Algeria

Argentina

Mexico

Nigeria

This is a significant threat to US dollar hegemony and eventually the global balance of power and will be worth keeping a close eye.

Property Market Showing Signs Of Distress

We are starting to see the very real effect of the prolonged rate rises and today saw both

Porter Davis, and Lloyd Group go into liquidation.

This is the sort of pain that reserve banks have been waiting to see before they consider a reduction in the rate rises. It will be interesting to see the RBA’s decision on Tuesday. Westpac economists expected a pause to rate rises and these recent liquidations might have confirmed it.

US commercial vacancy rates are also at all time highs with no rent being paid on 18.7% of offices. Is the reckoning about to arrive?

Vacant office space in the US is at its highest level ever of 18.7% 🚨

— Joe Consorti ⚡ (@JoeConsorti) March 28, 2023

No rent is being paid on 1/5th of all US office space.

$46 billion of variable rate office debt will mature and need to be rolled this year — get ready for a wave of defaults on commercial real estate loans: pic.twitter.com/mBF9ApFH6P

Education

Education

Written by Bisher Khudeira

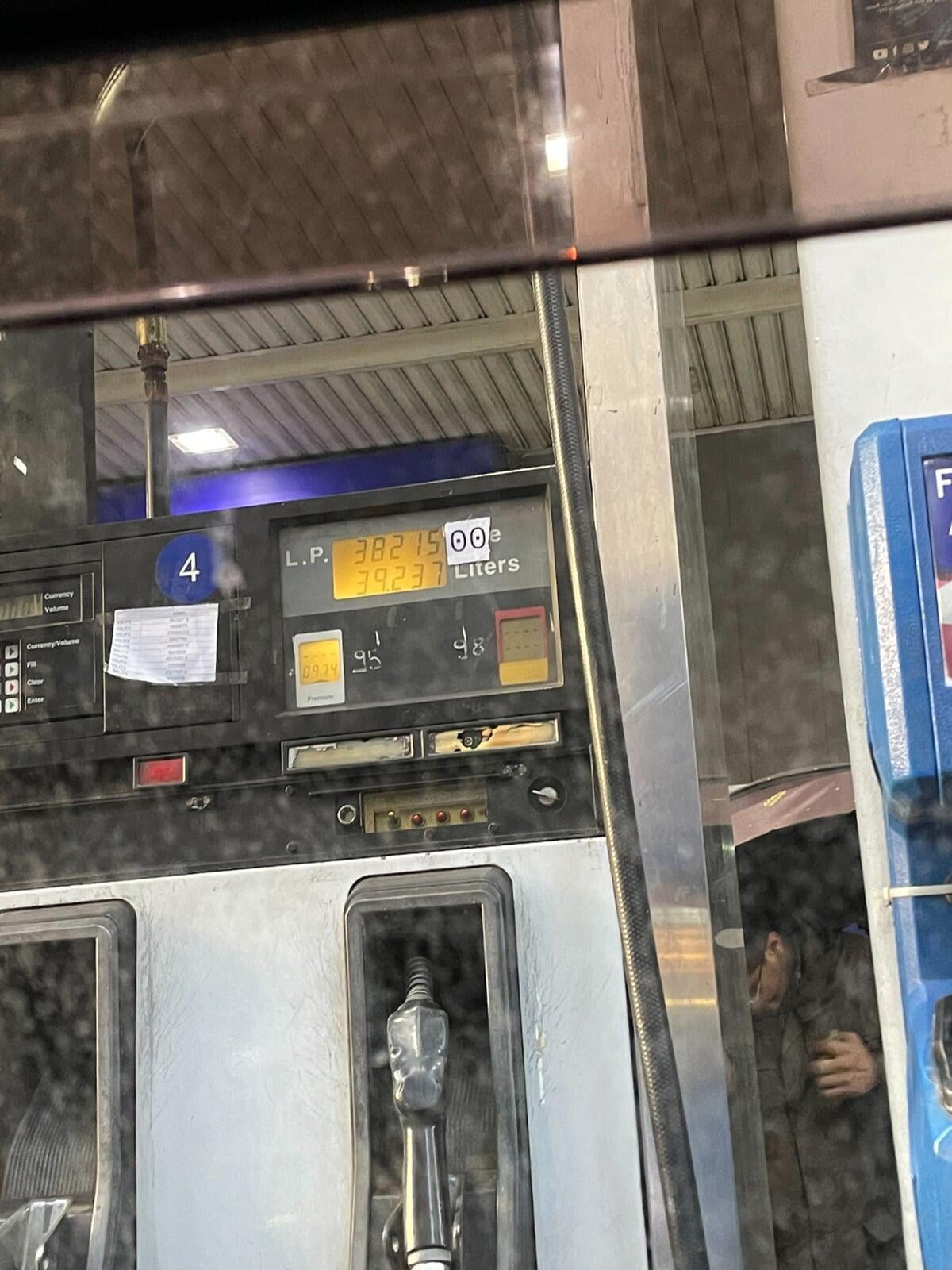

This is best exemplified when we went to fill up petrol from the gas station. A simple 40 litres sets back the Lebanese family, a whopping 382 Million LBP. In the face of soaring hyperinflation and worthless LBP, the economy and the people of Lebanon have turned to the USD as salvation. The issue with this solution is that the banks take huge fees on USD deposits sent into their banks, for example if I were to send $1,000 USD to a family member they may only see $500 - $700 of that transfer.

If only there was a solution available where the citizens can become their own bank and freely send and receive funds without an intermediary. In steps Bitcoin to save the beleaguered citizens of Lebanon.

In the Lebanese economy, the citizens have turned to bitcoin and other cryptocurrencies to avoid the aggressive bank charges, circumvent the government's corruption and forge a financially sound future despite the macroeconomic environment around them. You see them willingly spending their LBP as fast as possible. They hold USD in the short term, for more expensive purchases (a dentist appointment for example) and they save in Bitcoin, the ultimate hard currency.

This salvation cannot be understated, as it gives hope to Lebanon's youth. The working class finally has a pure savings account and the elderly can receive money without interference from corrupt government officials.

The reason I share this with you all is so that you can be best prepared for when this reality eventually befalls the AUD, and yes even the USD. We have seen 50 years of this fiat experiment and all it has done is impoverish most of the world and have the developed world living pay cheque to pay cheque, as they simply tread water in a debt laden system.

Hyperinflation doesn't happen gradually, it doesn't give you a chance to jump ship and move your wealth elsewhere. it happens suddenly, as the citizens of Lebanon had to learn the hard way when their currency was devalued 90% overnight so that the government can continue to meet their debt obligations to the Western world.

You may falsely assume "well this won't happen here, this is Australia". However, the statistics are not on your side because over 99% of fiat currencies that have ever been circulated, have failed. Roman Dinars and Dutch Guilders used to be the superpower currency of their age but now they are a mere historical footnote.

The team here at Stormrake are giving you an incredible opportunity to get onboard the Bitcoin lifeboat before your savings account evaporates by over 90% in one night. If this reality doesn't befall you in your lifetime, it edges closer generation after generation, so for those who want to leave a lasting legacy of support to their offspring, get your bitcoin before it's too late. Don't let them line up to the crypto store to exchange their worthless fiat currency for a a minuscule fraction of Bitcoin.

Memes of the month

The Credit Suisse collapse was highly meme'd

Bitcoin had the last laugh

Jerome Powell has no easy task but some suggest there is no way out of the destruction.

Start Your Brokerage Account

If you enjoyed this Rake Review, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2022 Stormrake Pty Ltd, All rights reserved