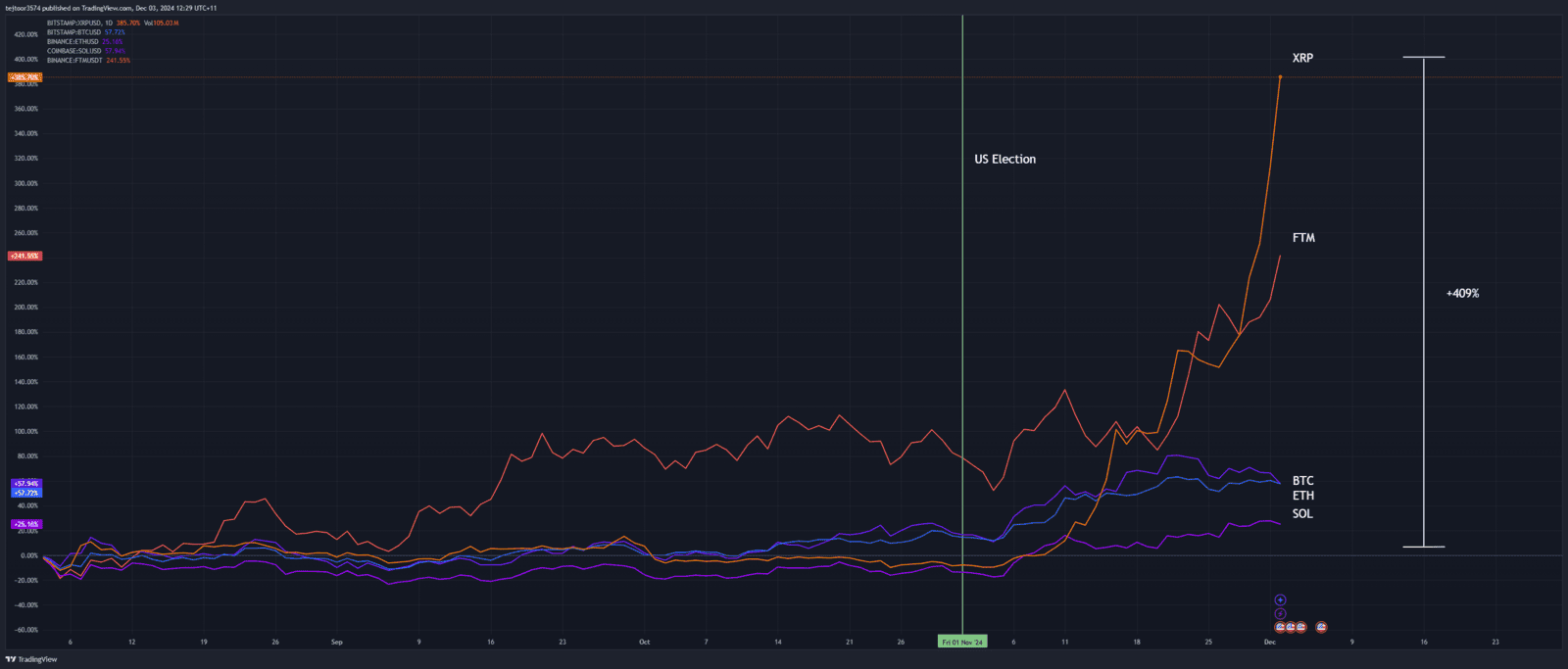

XRP’s meteoric rise began alongside the broader market rally following the US election results. Trading below $0.50 at the time, XRP surged to $0.70 as market momentum gathered pace. However, XRP outperformed nearly every other cryptocurrency, leveraging this momentum to skyrocket and leave much of the market in its wake. The chart above highlights XRP's remarkable 409% rally since the election, climbing to $2.73. Comparatively, Fantom (FTM) rose 130%, Bitcoin (BTC) gained 43%, Ethereum (ETH) advanced 53%, and Solana lagged with a 25% increase over the same period.

XRP's dramatic rise was spurred by significant news: an asset manager filed with the SEC to request approval for an XRP-focused large market ETF. This announcement coincided with news of Gary Gensler stepping down as Chairman of the SEC, which added fuel to the rally. Ripple’s years of legal battles with the SEC have long held back its performance, leaving it lagging behind the broader market for nearly eight years.

This rally has been long-awaited. XRP famously failed to reach a new all-time high during the 2021 bull run, with its record high of $3.40 set back in 2018. With its recent surge, XRP has surpassed its 2021 high and now has the potential to set a new all-time high.

Persistent XRP holders over the past seven years have finally been rewarded, but now may be a prudent time to take profits. With a 400% rally in less than a month, a significant pullback is likely. Even the most bullish trends do not move in a straight line, and XRP’s parabolic rise suggests a correction is inevitable.

While new all-time highs remain possible, diversifying into other assets like Bitcoin or coins that have yet to rally, such as Fantom (FTM), could be a wise strategy. For those worried about missing out, this is an excellent opportunity to strengthen Bitcoin positions as the market remains in its early stages, presenting compelling entry points. Contact your Stormrake Crypto Broker to take advantage of these opportunities.