Blog tagged as Alexandar Artis

Bitcoin consolidates as the dollar suffers its weakest yearly start in 30 years.

Bitcoin climbs amid tariff rollbacks and the dramatic fall of Mantra (OM).

Bitcoin climbs back above $83K as sentiment edges toward neutral and macro focus shifts to US10Y yields amid rising tariff tensions.

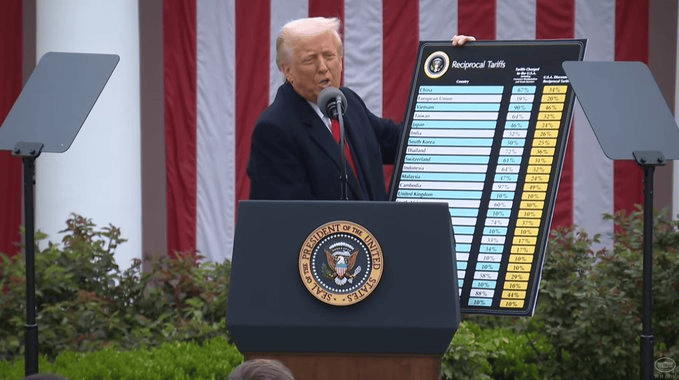

Despite the 90-day pause, tariffs remain the dominant force weighing on markets.

Markets post historic gains following Trump’s surprise 90-day tariff pause.

The S&P 500 suffers a sharp intraday bull trap, while Bitcoin fails to hold above $80K.

Amid fake headlines, tariff tensions, and global market chaos, Bitcoin showed surprising resilience with a volatile 10% swing, providing golden buying opportunities.

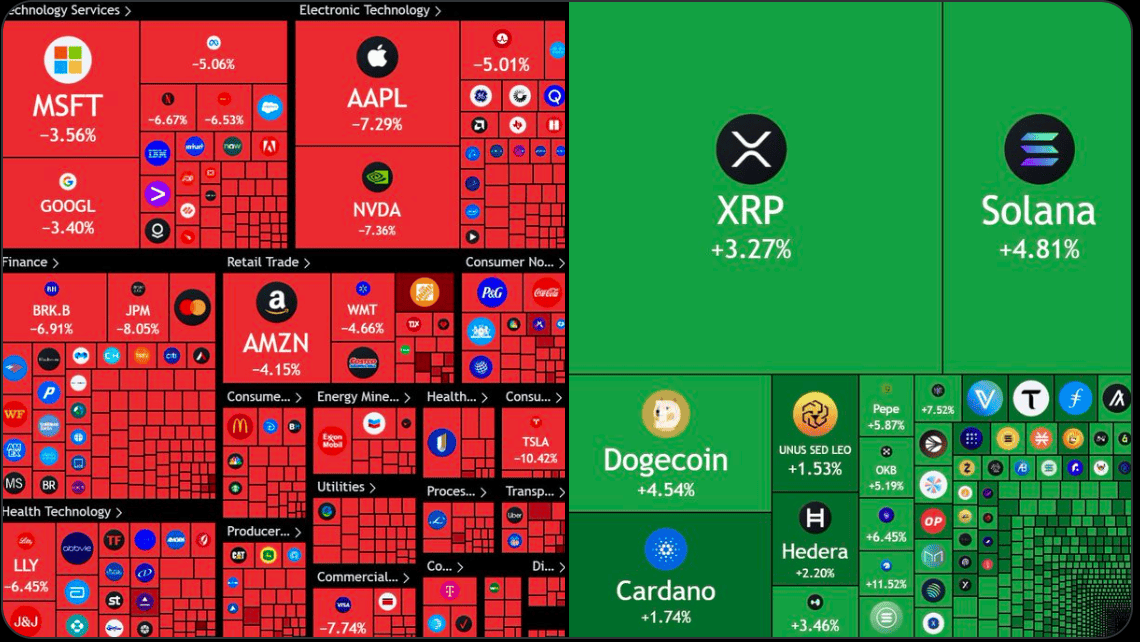

Crypto finally cracks, joining broader markets in a sharp sell-off this morning.

Bitcoin shows resilience with back-to-back gains, defying the broader market sell-off as traditional indices slide into bear territory.

A major cyber attack has compromised the security of several of Australia’s largest superannuation funds, exposing critical vulnerabilities in the system.

As stocks tumble, Bitcoin holds steady—hinting at a potential decoupling from legacy markets.

Markets rally, then unravel, as Trump’s Liberation Day announcement triggers risk-off chaos...

Bitcoin Reclaims $85K Ahead of Trump’s ‘Liberation Day’

After a disappointing March, we turn to a historically bullish April—will it deliver this time?

The most anticipated week of the year—not for optimism, but for the uncertainty and volatility it brings.

Bitcoin didn’t just move sideways in March—it moved up the geopolitical ladder. With the US formally designating Bitcoin as a strategic reserve asset, the digital currency took on a new identity: not just a hedge, not just an investment, but a tool of statecraft. Bitcoin became strategic.

The bears have reclaimed control ahead of what’s shaping up to be the most volatile week of the year so far…

Bitcoin is consolidating between $85.4K and $88.4K, forming a potential bull flag pattern that mirrors previous setups and could pave the way for a breakout toward $90K.

Bitcoin holds support despite renewed tariff pressures, whilst World Liberty Financial launch their own stablecoin and GameStop eyes a $1.3B Bitcoin play

With superannuation now a fiscal target and the AUD facing long-term risks, Bitcoin offers an avenue for enhanced financial sovereignty within an SMSF.