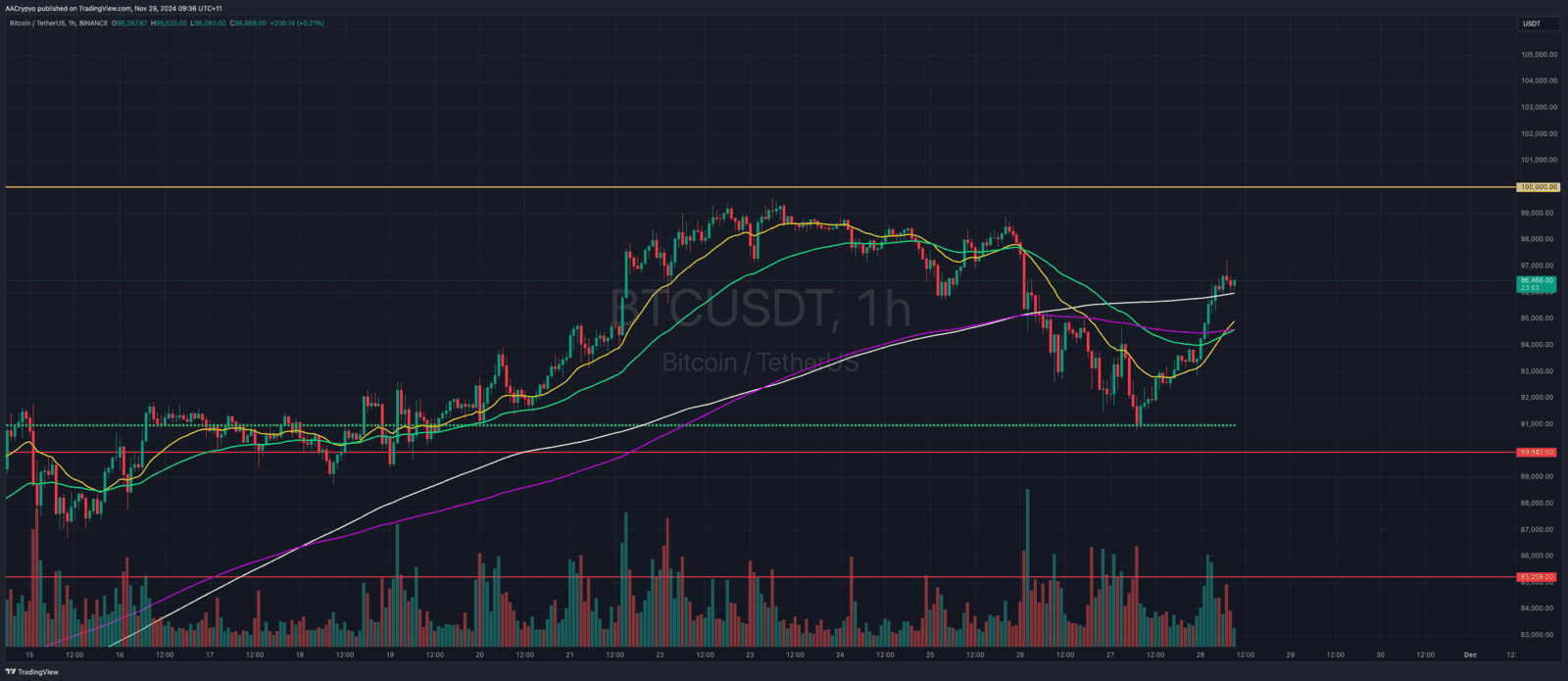

We’ve just witnessed the first significant bull market correction of this cycle. It was swift and less severe than many anticipated—characteristic of bull market corrections, which are typically short-lived and don’t dip as low as expected. Bitcoin has already rallied over 6% from its recent low and appears ready to attempt breaking the $100k barrier once again.

This correction lasted two days, during which Bitcoin dropped 9% to a low of $90.8k. Many had expected a larger pullback of over 10%, bringing the price below $90k. However, in true Bitcoin fashion, it defied expectations, rebounding quickly and leaving those waiting for lower prices behind. We urged you to capitalise on these discounted prices, emphasising that corrections in bull markets are fleeting opportunities. It’s not too late; historically, buying into strength has often yielded positive returns.

Yesterday’s recovery has positioned Bitcoin to retest $100k before the month’s end. This move has re-established a bullish structure and shifted momentum back in favor of the bulls. Breaking $100k this month could pave the way for Bitcoin to rally further, potentially reaching $110k or even $120k before Christmas. With another interest rate cut expected in December and the traditional "Santa Claus rally" on the horizon, Bitcoin’s potential trajectory looks highly promising. Don’t miss out by hesitating or trying to time the market—remember, time in the market beats timing the market.

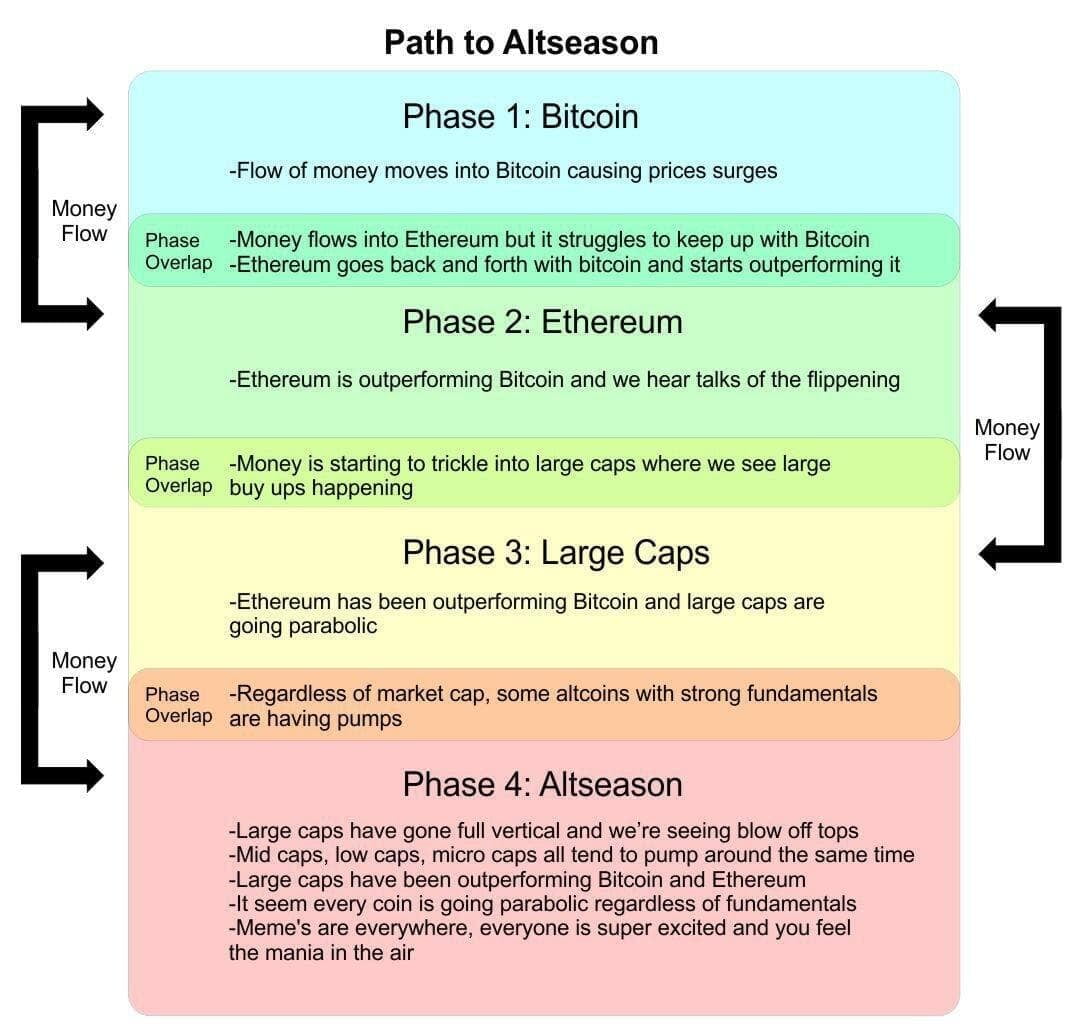

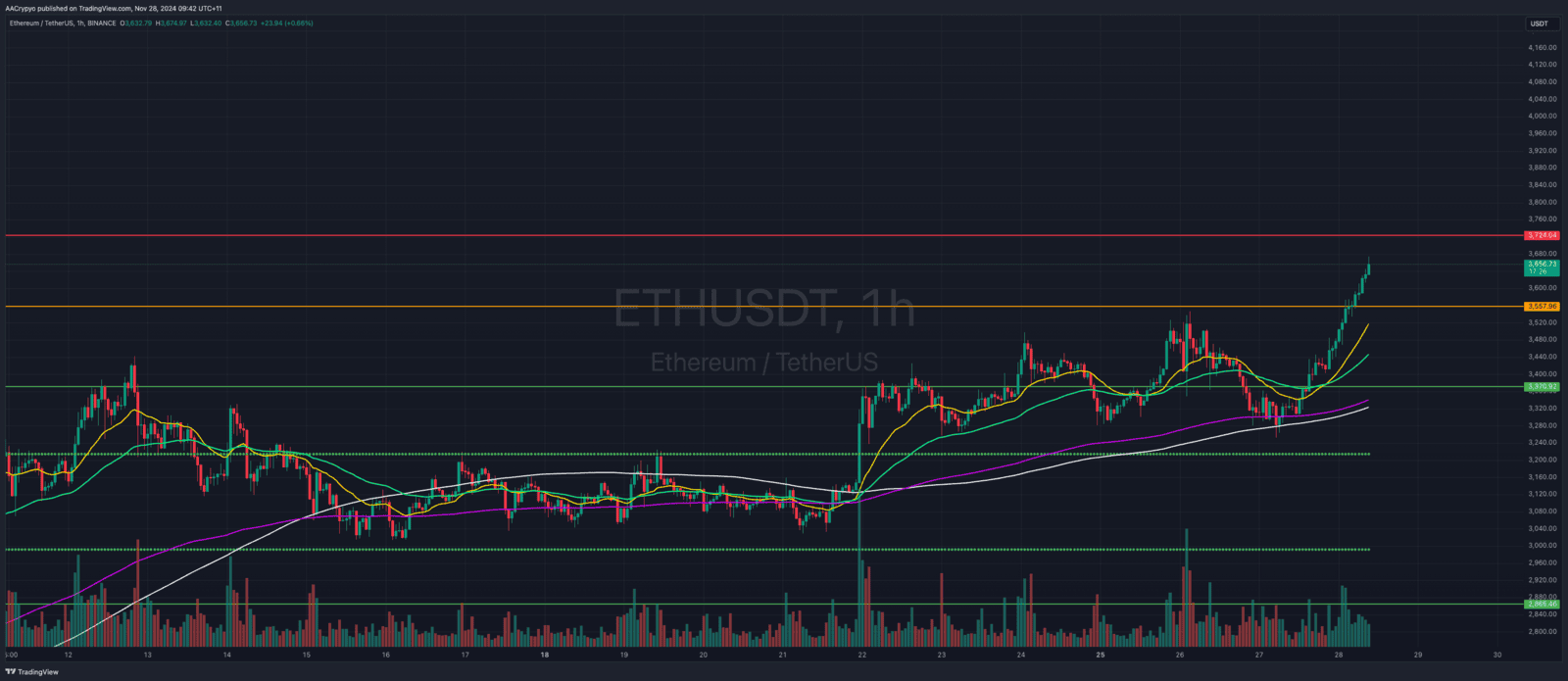

Interestingly, Bitcoin dominance continues to decline despite the overnight rally, with altcoins outperforming significantly. The altseason index has surged to a reading of 65! Ethereum is not only outperforming Bitcoin but also leading the charge alongside key projects on its network, including Ethereum Name Service, Uniswap, Ethena, Ethereum Classic, Lido, and Aave. This trend highlights a growing pattern: when a major blockchain like Ethereum, Solana, Sui, or Fantom leads the market, its associated protocols tend to experience even stronger rallies. To capitalise on this, research the leading applications and protocols on these blockchains and leverage their strength.