Blog tagged as ETH ETF

Are you ready to capitalise on Bitcoin’s prolonged consolidation and position yourself for the next big move?

Trump announces plans for reciprocal tariffs, reigniting trade tensions and shaking global markets.

Trump announces plans for reciprocal tariffs, reigniting trade tensions and shaking global markets.

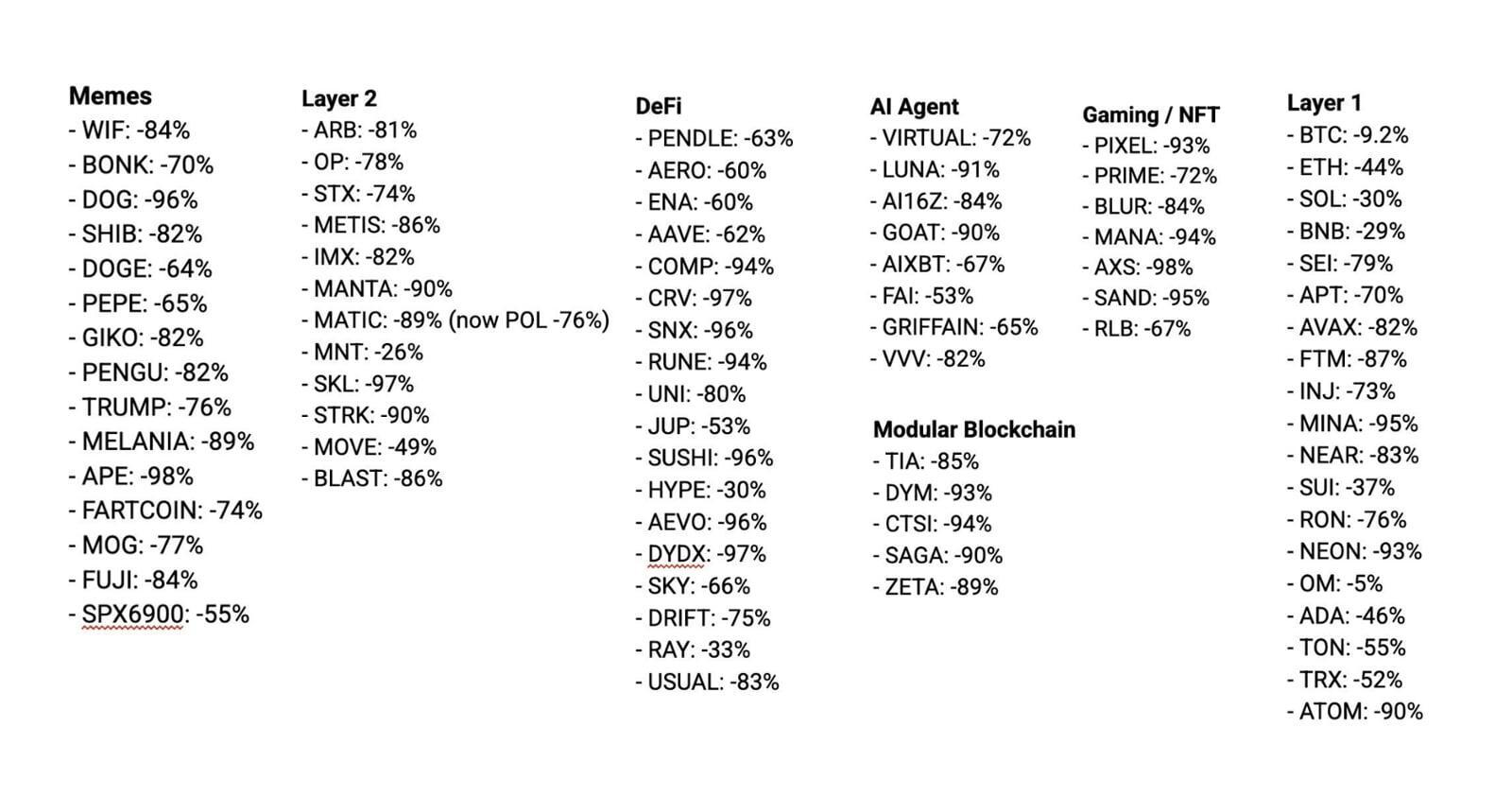

While many altcoins remain far from their 2021 all-time highs, Bitcoin has continued setting new records this bull cycle.

For the third consecutive day, another major player has been revealed to be accumulating Ethereum.

Markets tumble as David Sacks delivers a neutral speech, falling short of investor expectations.

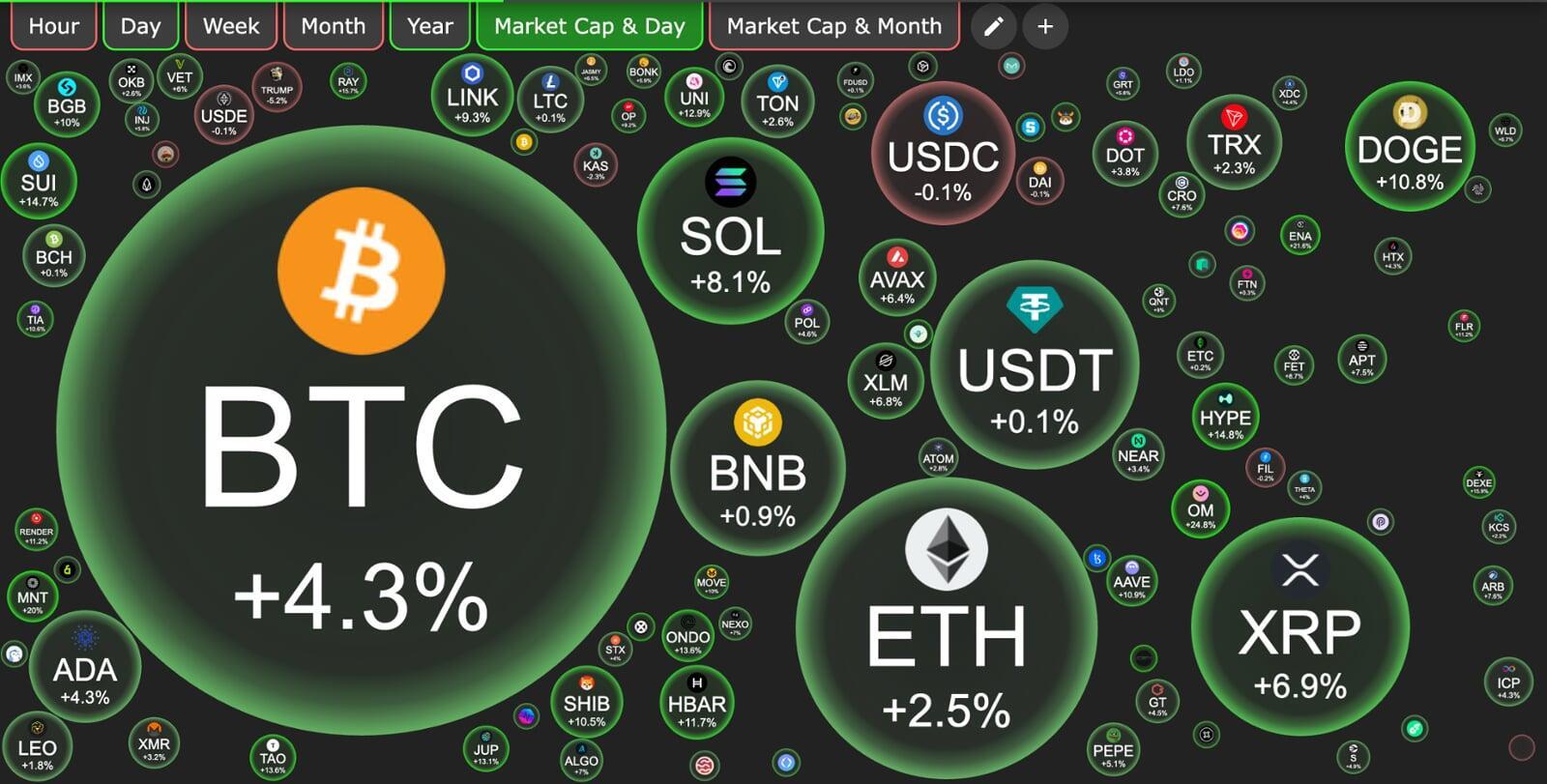

The US and Canada have agreed to pause tariffs for 30 days, sparking a sharp crypto market rebound.

Canada has retaliated against America’s tariffs, sending markets into a sharp downturn.

The crypto market reacts to broader risk-off sentiment following the confirmation of new tariffs.

Bitcoin closes January in the green, marking 10 out of 15 positive Januaries since 2011.

An event-packed January comes to an end, and Bitcoin is set to close positive once more, up 11%.

This morning’s FOMC decision and press conference triggered volatility, but Bitcoin ultimately came out on top.

With Bitcoin hovering at a key level and the FOMC decision looming, the next 24 hours promise heightened volatility.

Traditional markets remain under pressure, while Bitcoin and the broader crypto market demonstrate a resilient and promising recovery.

Bitcoin tumbles in tandem with the Nasdaq following the launch of DeepSeek AI.

We now await the next catalyst to determine Bitcoin's direction and potentially shape the market's trajectory.

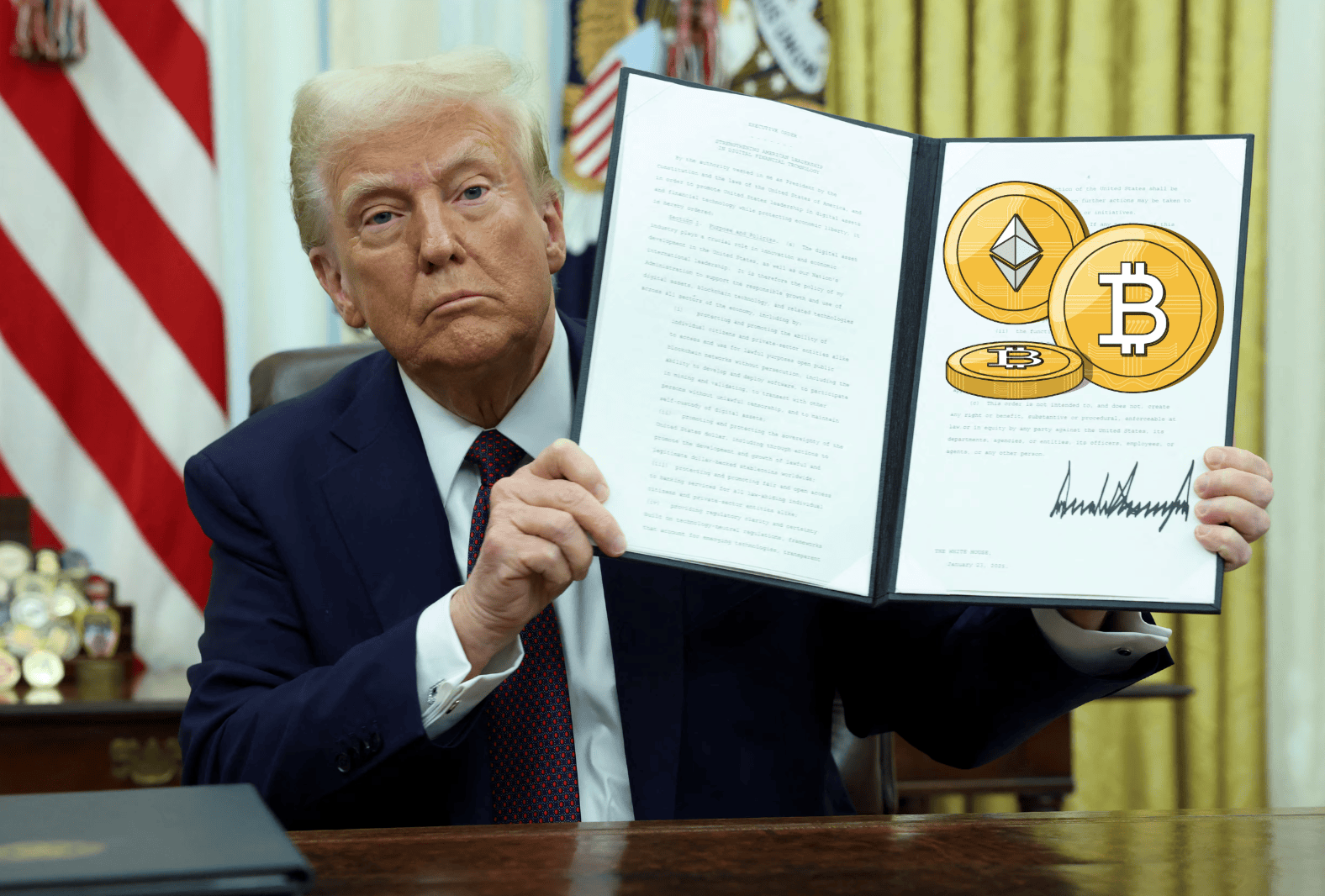

The first crypto executive order has been signed but the market has reacted poorly...

CME may launch SOL and XRP futures markets as early as next month, pending regulatory approval.

The crypto market rallies following the announcement of the new SEC crypto task force.

A turbulent 24 hours for Bitcoin amid Trump's inauguration.